The Evolution of Investment Strategies

Investment strategies have evolved significantly over the years, and with the advent of technology, this evolution has accelerated. The integration of artificial intelligence (AI) and other innovative technologies is reshaping the investment landscape, leading to modern strategies that are more data-driven and efficient.

Role of Artificial Intelligence in Investing

AI’s impact on investing is profound, offering new ways to analyze large datasets and make more informed decisions. AI algorithms are capable of processing vast amounts of data quicker than human analysts, identifying patterns, and predicting market movements. These advancements have made AI a key component in developing automated trading platforms and robo-advisors.

Many investment firms are adopting AI to optimize portfolios. By leveraging machine learning, they can customize investment strategies tailored to individual risk appetites and financial goals. For instance, AI-driven platforms can automatically rebalance portfolios, ensure diversification, and minimize risks, enhancing overall investment performance. As technology progresses, the precision and scope of AI-driven analysis and its application in investment arenas are anticipated to expand further, making AI an indispensable tool for investors.

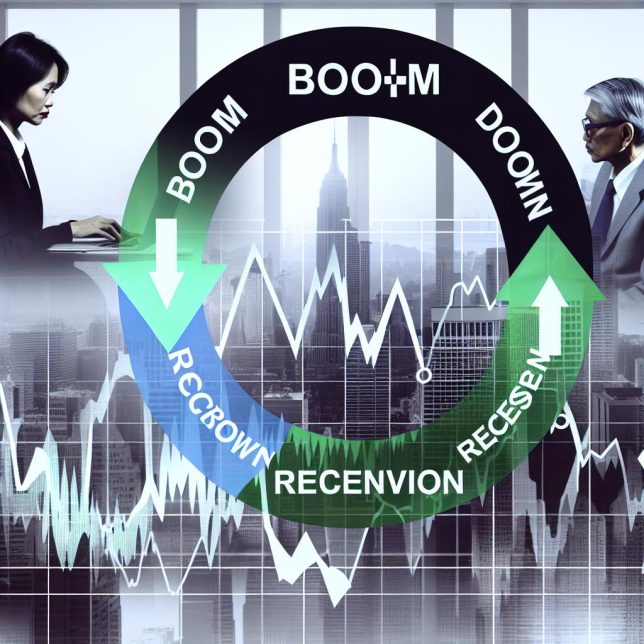

Algorithmic Trading and Market Efficiency

Algorithmic trading, which utilizes pre-programmed instructions to execute trades, benefits immensely from AI and machine learning. It ensures trades are executed at the best possible prices, limits market impact, and reduces human error. The incorporation of AI into algorithmic trading systems allows for adaptive algorithms that can learn from market movements and other macroeconomic factors, enhancing their effectiveness and reliability over time.

AI’s ability to forecast market trends with high accuracy contributes to market efficiency. This improvement means that financial markets now reflect asset prices that are more aligned with their intrinsic value due to faster, more precise data analysis. Additionally, the capacity of AI to process complex datasets in real time helps identify pricing anomalies and rectify them almost instantly, aiding an efficient market hypothesis.

Implications for Retail Investors

Thanks to AI and technology advancements, tools that were once exclusive to large institutions are now accessible to retail investors. Platforms offering robo-advisory services provide personalized advice at a fraction of the cost of traditional advisory services. This accessibility has democratized investing, allowing retail investors to manage their portfolios much like professional fund managers. Retail investors can benefit from these technology-driven platforms through real-time insights, custom portfolio building, and ongoing monitoring and rebalancing without the high fees associated with traditional financial advisors.

The ease of access to robust analytical tools empowers retail investors to make well-informed decisions. They can now harness AI-driven insights and predictive analytics to compare performance metrics and scrutinize market conditions. Overcoming prior barriers, retail investors can now engage in more sophisticated investment strategies, including those incorporating algorithmic trading and ESG factors, ensuring a more holistic approach to personal finance and wealth management.

Innovations in Financial Markets

The financial markets are undergoing radical transformations driven by technological innovations beyond AI. For example, blockchain technology is revolutionizing how transactions are conducted and recorded, enhancing security and transparency. Blockchain-based platforms are paving the way for decentralized finance (DeFi), offering new investment products and opportunities that challenge traditional financial systems. The underlying decentralized nature of blockchain removes intermediaries from financial transactions, accelerating processes and reducing associated costs.

Furthermore, the rise of environmental, social, and governance (ESG) criteria in investment decisions is noteworthy. Investors are increasingly factoring in ESG metrics to assess a company’s long-term sustainability and ethical impact. Companies that score well on ESG factors are often perceived as less risky and more likely to perform well in the long run. This practice not only promotes responsible investment but also guides companies toward socially conscious practices, fostering a more sustainable future.

Moreover, the adoption of big data analytics further complements these technological advancements. Big data assists investors in identifying trends and insights that would otherwise be concealed in plain sight. By leveraging vast amounts of data, investors can identify upcoming sectors and trends, ensuring they are ahead of the curve. This synergy between AI, blockchain, ESG, and big data is beginning to set a new standard in investment strategies, leading toward a future of robust and informed investment landscapes.

Conclusion

As the investment landscape continues to evolve, the influence of AI and market innovations cannot be overlooked. From algorithmic trading to ESG investing, these trends promise to reshape how investments are managed and executed. Investors, whether institutional or retail, must stay abreast of these developments to capitalize on the opportunities they present and navigate the challenges they bring. The intersection of technology and finance has not only introduced new challenges but has also opened doors to opportunities that can drive future growth. As technology becomes more intricately woven into the fabric of financial operations, the ability to adapt and innovate remains crucial for investors of all calibers.