If you trade FX from Nairobi, Mombasa or anywhere else in the country, you are not just choosing “a broker”, you are choosing a licence type, a regulator and a business model in one go. That choice affects what products you see on the screen, how your orders are routed, who holds your funds and what happens if something goes wrong.

Kenya has done more than most African countries when it comes to regulating online forex. The Capital Markets Authority (CMA) has built a formal framework for online foreign exchange trading, defining clear licence categories for brokers who deal directly with clients, those who don’t take the other side of trades, and money managers who trade on behalf of investors.

At the same time, many Kenyan traders still sign up with international offshore brokers that market aggressively in the country but are regulated in places like Cyprus, the UK, or various island jurisdictions. The CMA has made it clear: if you trade through a broker that isn’t licensed locally, you’re stepping outside Kenya’s legal safety net. If something goes wrong, you may have little to no protection under Kenyan law.

So when you say “forex broker in Kenya”, you are really talking about a few buckets:

- CMA-licensed online forex brokers, split into dealing and non-dealing categories

- CMA-licensed online forex money managers

- Unlicensed offshore brokers that accept Kenyan residents even though they do not hold a local licence

Once you understand how those buckets work, you can look at the marketing on a broker’s website and see what actually sits behind phrases like “STP”, “ECN” or “local Kenyan broker”.

CMA regulation and the licence categories that exist in Kenya

The starting point is the Capital Markets (Online Foreign Exchange Trading) Regulations, first issued in 2017 and since updated. These rules define who can provide online forex trading services to the public, the types of licences they can hold and the conditions attached.

The CMA keeps a public register of licensed market players. Among the many categories (investment banks, stockbrokers, fund managers and so on) you will see two labels that matter directly for FX traders:

“Non-dealing online foreign exchange broker”

“Online foreign exchange money manager”

The regulations also refer to “dealing online foreign exchange brokers”, even though in practise the bulk of licences granted so far have been in the non-dealing category.

A few points are worth spelling out.

First, anyone marketing online forex brokerage services to the public must show proof of CMA licensing in the correct category. The regulator and local press have stressed that offering brokerage services without that licence breaches the law.

Second, the rules distinguish between firms that provide a trading platform and link clients to the market (brokers), and firms that actually handle client money and place trades on a discretionary basis (money managers). The same company can, in theory, apply for more than one licence, but each role is treated differently in the rules.

Third, the regulations cover online forex trading “to the Kenyan public”. That is why CMA has cautioned both foreign brokers and Kenyan traders about using offshore platforms; from the regulator’s side, a broker onboarding Kenyan residents and advertising locally should hold a local licence, not just a remote one.

In short, the regulatory types you see inside Kenya are defined by law, not by marketing brochures. The law draws the lines between dealing, non-dealing and money management. The familiar retail terms like “market maker”, “STP” and “ECN” then sit on top of those legal categories, which sometimes causes confusion.

Dealing vs non-dealing online forex brokers

The regulations separate online forex brokers into two main flavours: dealing and non-dealing. On paper the difference is simple; in practise it has big consequences for how your trades are handled.

A dealing online forex broker is authorised to act as principal. In plain language, that means the broker can quote prices, take the other side of your trades and run a dealing book. This is the standard retail “market maker” model many traders are familiar with from other regions. The broker can provide a platform, quote bid and ask prices and choose whether to hedge exposure with external liquidity providers or keep some part of it in house.

A non-dealing online forex broker, by contrast, acts as a link between the client and the wider forex market in return for a commission or spread mark-up. The broker is not allowed to engage in market-making activities; it should not be running a proprietary book that takes directional exposure against clients. In practice this lines up with what global traders call an STP-style model, where the broker passes client orders out to banks or other liquidity providers.

Non-dealing brokers still provide the front-end platform and handle client onboarding, KYC, support and account statements. The difference is in how your trades are processed on the back end. Your EURUSD order is supposed to go out to external liquidity, not sit as a direct exposure on the broker’s internal dealing desk.

The majority of CMA online forex licences granted so far have been in the non-dealing category. Big local names such as FXPesa and Scope Markets Kenya operate as non-dealing brokers, routing client trades to external providers while earning from spreads and commissions.

For a Kenyan trader the practical difference looks like this:

With a dealing broker, you trade directly against the broker, and the firm may or may not hedge your exposure elsewhere.

With a non-dealing broker, you still face the broker as your contractual counterparty, but your orders should be matched against external liquidity instead of the broker’s own book.

Both types fall under CMA rules on capital, conduct and reporting. But the conflict of interest is more obvious at a dealing broker, where your loss can translate into revenue for the firm if they keep risk internal. With a non-dealing broker, the business survives on volume and mark-ups, not on betting against clients.

Online forex money managers and managed accounts

Alongside brokers, the Kenyan framework includes “online foreign exchange money managers”. These are firms or individuals authorised to trade forex on behalf of clients, usually via managed accounts, PAMM structures or similar pooled setups.

The idea is to separate two functions that often get mixed in retail FX:

Providing a platform and price feed so clients can trade their own accounts

Taking in client funds and making trading decisions for them

A money manager licence is aimed at the second role. The manager can control trading on client accounts within agreed mandates but must follow extra rules on disclosure, reporting and risk. Anyone “running accounts” for other people without that licence falls foul of the regulations, even if they try to hide behind copy-trading or vague “advisory” language.

From your side as a trader or investor, there are two basic ways you might meet a money manager:

You sign a managed account agreement with a licensed money manager, who then trades your account at a licensed broker under a power of attorney or similar arrangement.

You join a pooled structure such as a PAMM at a broker, where the manager’s trades are mirrored into your account based on your share of the pool.

In both cases you are handing over trading control, which raises a different set of questions from normal self-directed trading. You care less about platform features and more about track record, risk limits, drawdown rules and how money is segregated between clients.

The CMA framework tries to keep roles clear. Brokers should not trade client accounts on a discretionary basis unless they also hold the money manager licence. Money managers should not provide the execution platform themselves unless they also hold the relevant broker licence. In practise there can be group structures where one brand handles brokerage and an affiliated entity handles money management under separate licences.

For Kenyan traders this matters because unlicensed “account managers” and social media signal sellers have been a common source of blow-ups. The regulator has repeatedly warned that handing funds to unlicensed entities or letting them trade your account leaves you exposed with little recourse.

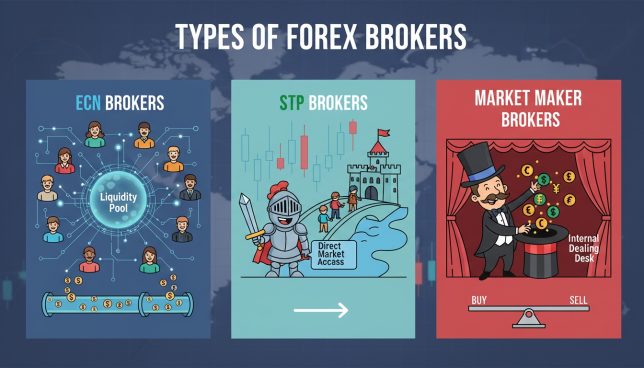

Business models behind Kenyan forex brokers: market maker, STP and ECN

The CMA licence labels tell you whether a broker is allowed to run a dealing book or must act as non-dealing. On top of that, brokers describe themselves in global retail FX jargon: market maker, STP, ECN, DMA and hybrid. Kenyan traders see the same phrases, just with a local licence attached.

A dealing online forex broker lines up with the traditional market maker model. The firm sets its own bid and ask prices around a reference feed. You hit those quotes, and the broker may leave your exposure internal or hedge part of it. Profit comes from the spread and, where risk is kept, from client losses over time after netting winners against losers. That can be efficient for micro-lot clients, but it creates an obvious conflict between the firm’s book and profitable traders.

A non-dealing online forex broker is supposed to run closer to STP. The broker aggregates quotes from external liquidity providers, adds a small mark-up or charges a commission and streams that to clients. When you trade, your order goes straight through to those providers in the background. The broker earns on volume, not on your P&L.

Some Kenyan brokers also offer “ECN” or “raw spread” account types. In those accounts the spread you see is closer to the underlying bank stream, often very tight on major pairs, with a separate per-lot commission. The broker’s role is to provide access to that pool of quotes and match your order against them. In practise this is a flavour of non-dealing model with a different pricing structure.

Hybrid set-ups exist too. A broker might route larger, more sophisticated clients directly to aggregated liquidity while leaving very small tickets on an internal book because hedging every tiny trade separately would be inefficient. You rarely see this described in detail on the website, but it sits behind phrases such as “smart order routing”.

For a Kenyan trader looking at account types, the takeaway is simple. The CMA licence tells you what the firm is allowed to do under law (dealing vs non-dealing). The marketing tags then hint at how they actually implement that permission: market-making, STP, ECN or a mix. Your job is to read the fine print and, if you care about execution quality, ask direct questions about routing, slippage reports and quote sources rather than just trusting the headline label.

CMA-licensed brokers vs offshore brokers accepting Kenyan clients

On the ground, Kenyan residents face a practical choice. Do you stick to CMA-licensed online forex brokers, or do you open accounts offshore with international brands that accept Kenyan sign-ups but do not hold a local licence.

CMA and legal commentators are quite clear on their view. Online forex trading offered to the Kenyan public is a regulated investment service, and anyone providing it is supposed to hold a licence as a dealing or non-dealing broker or as a money manager. The regulator has issued cautionary statements saying that trading with unlicensed entities exposes investors to loss without the protections of the local framework, and has told foreign brokers not to solicit Kenyan clients without a licence.

Despite that, many well-known international brokers list Kenya in their country drop-down and accept clients under offshore or foreign licences. Guides to “best forex brokers in Kenya” on comparison sites regularly include both CMA-licensed firms and offshore ones. That puts traders in a grey zone where the practice of the market and the stance of the local regulator do not fully match.

The practical differences between a CMA broker and an offshore one look like this:

With a CMA-licensed broker, your contract is with a Kenyan entity supervised by CMA. Disputes can be brought through local channels, and the firm must follow the local rulebook on capital, disclosures and conduct.

With an offshore broker, your account is with a foreign entity under another regulator (or occasionally under weak supervision). If something goes wrong, your recourse is through that foreign regulator and legal system, not through CMA.

Some offshore brokers bring strong global regulation to the table, such as oversight from the UK FCA or similar agencies. Others are registered in offshore centres with lighter rules. In either case, they fall outside the Kenyan regulatory perimeter, even if they offer Kenyan-friendly funding methods and Swahili-language support.

There is no universal answer which route is “better”. Many traders simply prefer the comfort of dealing with a locally supervised firm, even if the product range is narrower. Others accept the extra legal distance because they want access to very high gear, a broader list of CFDs or certain platforms. The main thing is to be honest with yourself: if a problem arises, where exactly would you stand.

Typical account features and trading conditions for Kenyan traders

Beyond pure licence type, brokers that serve the Kenyan market share some very concrete features. These matter day to day once you are actually trading.

Local CMA-licensed brokers tend to support popular retail platforms such as MetaTrader, along with web and mobile apps branded under their own names. Product ranges usually include major and minor FX pairs, index CFDs, commodity CFDs and sometimes share CFDs, all under one multi-asset account.

Funding and withdrawals are adapted to local habits. Many brokers offer card deposits, bank transfers through Kenyan banks and mobile money channels. Minimum deposits are set low enough for small retail accounts, with cent-style accounts in some cases. Overnight swaps, margin requirements and stop-out levels are laid out in the account terms. Because of local rules, CMA-licensed brokers do not always offer the extreme gear advertised in some offshore jurisdictions, but they still offer high magnification by developed-market standards.

Offshore brokers that target Kenyan residents often try to compete with wider product lists and more exotic CFDs: single-stock CFDs from many exchanges, crypto-based products and higher gear. They also push bonuses or promotions more aggressively, though those are subject to various restrictions in other regions.

In day-to-day trading, Kenyan clients at both local and offshore brokers care about roughly the same things:

Tight pricing on majors such as EURUSD and GBPUSD

Stable execution around normal sessions; fair treatment during news events

Fast, predictable withdrawals through channels that work smoothly inside the country

From a content point of view, none of that is glamorous, but it is what makes a broker tolerable over months and years rather than just during the first demo week.

Matching broker type to your style and what to check before you fund

Once you know what types of forex brokers actually exist in Kenya, the choice becomes less “which broker is best” and more “which set-up fits what I am trying to do”.

If you are a small retail trader, running a modest account and trading a few times per week, a CMA-licensed non-dealing broker will often do the job. You get a familiar platform, pairs that cover your needs, local funding options and supervision from a regulator you can actually call if something goes badly wrong. Dealing with a firm that has a full office in Nairobi can also make a big difference the first time you have a dispute over fills or withdrawals.

If you are more active, maybe day trading news or running semi-automated strategies, then how the broker routes orders and prices spreads matters more. You might lean toward ECN-style or “raw spread” accounts at a non-dealing broker, or you may decide to split funds between a local broker for comfort and an offshore ECN broker for certain strategies. The boredom of checking execution statistics, slippage reports and uptime numbers is worth it at that point.

If you are thinking about handing money to someone else to trade, the licence type becomes non-negotiable. In Kenya, a person or firm that trades forex on behalf of clients should hold the money manager licence, not just “have a good strategy”. Your due diligence list shifts from “how fast is the platform” to “how is risk measured, how are fees structured, who audits the track record, and what is the legal agreement actually saying about loss sharing”.

A simple habit helps in every case: before you send money, find the broker or manager on the CMA licence search page and confirm the precise category they are in. Then match that category to what they claim on their website. If the story lines up, good. If there is a gap, take that as a warning sign, no matter how friendly the sales rep sounds on WhatsApp.

The Kenyan forex market is crowded with marketing slogans, but the underlying types of brokers are not mysterious. Once you understand dealing versus non-dealing, broker versus money manager, and local versus offshore, choosing where to trade stops feeling like a gamble and starts feeling more like a business decision. Which, quietly, is what it should have been from day one.

This article was last updated on: February 17, 2026