If you trade spot FX long enough, you realise you are not just trading EURUSD or GBPJPY, you are also trading your broker’s business model. The way a forex broker earns money, takes risk and routes orders has a direct effect on spreads, slippage, order rejections and even how your account is treated in a flash crash.

In foreign exchange there is no central exchange book for spot trading. Prices come from banks, non-bank liquidity providers, prop shops and other market makers quoting into networks. Your broker sits between you and that network. Some brokers take the other side of your trade first. Some pass everything on. Some mix both depending on your profile or the pair you trade.

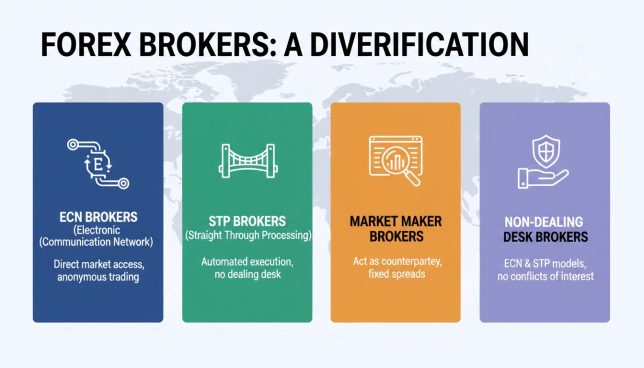

Most retail traders see three labels over and over: market maker, STP and ECN. On top of that you get more marketing: “no dealing desk”, “true ECN”, “raw spreads”, “DMA” and so on. The labels are not just buzzwords. They describe how order flow is handled and who holds which part of the risk.

You do not need to become a backend engineer or ex-bank dealer to choose sensibly, but you do need a clear picture of how these broker types behave on a normal day and on a bad day. Once that is clear, matching a broker type to your trading style and account size gets much easier and you stop treating the broker like a black box that randomly blesses or ruins trades.

This article focuses on explaining different types of forex brokers to you. If you want to find a broker to open an account with them, we recommend you visit ForexBrokersOnline.com instead. It’s a website that makes it very easy to find and compare Forex brokers

Market maker / dealing desk forex brokers

The classic retail forex broker model is the market maker or dealing desk. Here, the broker quotes its own bid and ask prices around some reference feed, you trade against those prices, and the firm takes the other side of your position, at least initially.

How dealing desks usually work

Inside a dealing desk broker, client flow is grouped and monitored. When you buy EURUSD, the broker’s internal book goes short EURUSD against you. If many clients are long the same pair, the broker has a net short position. The firm can leave that risk “internal” and hope client flow will tend to lose over time, or hedge part of it with external liquidity providers, usually at better prices thanks to institutional spreads.

The profit engine is simple. The broker earns the spread and any net client loss on positions that are not hedged away, minus hedging costs and overheads. On the other side, if a cluster of clients is good and keeps winning, those positions may be passed straight out to external providers, so the broker just earns spread and small markups while avoiding directional risk. This is often called B-booking versus A-booking, even though many clients never see those terms in the app.

From the trader’s point of view, the good part of this model is convenience. Account minimums tend to be low. Micro-lot trading is common. It is easy to get high leverage and access to many exotic pairs and CFDs tied to indices, metals and energies, all in one place. The platform will often feel polished because the broker controls the entire chain from pricing to charts.

Where conflicts of interest appear

The obvious problem is conflict of interest. When your loss can be the broker’s gain, incentives are not perfectly aligned. That does not mean every dealing desk is out to hunt stop losses, but it does mean you should be alert to how the firm behaves around news releases, rollovers and thin liquidity.

Requotes and “off quotes” messages usually happen at dealing desk brokers when the internal pricing engine cannot match your requested fill with its current book or risk limits. In fast markets, the broker may widen spreads sharply or temporarily disable market orders to control exposure. You might also see asymmetric slippage, where you tend to get worse fills when the move is against you and very little positive slippage when it would be in your favour.

A well-run market maker will manage these issues with transparent policies, clear statements about how they quote, and strong regulation that forces segregated client funds and minimum capital levels. A weaker one may rely on poor disclosures, aggressive marketing and very high leverage to attract clients, then treat the internal book as a casino house edge.

Where market makers still make sense

Market maker brokers can still be reasonable for small retail accounts, especially when you trade small size, hold positions for longer periods, or use them mainly for majors and liquid crosses. Tight typical spreads, stable platforms and responsive support can outweigh theoretical conflicts for a thousand-dollar account trading micro lots. The problems start when serious size meets poor risk management on the broker side.

STP (straight-through processing) forex brokers

STP brokers try to position themselves as a step closer to “real” liquidity. The idea is simple on paper: instead of internalising client trades, they route orders straight to external liquidity providers, usually banks and non-bank firms that quote into an aggregation engine.

How STP routing actually behaves

In an STP setup, the broker runs an internal price aggregator that collects bid and ask quotes from several liquidity providers. It then adds a small markup on the spread, or sometimes a commission, and streams that price to your platform. When you place an order, the trade is filled against one or more of those providers. The broker earns on that markup or commission rather than from your losses.

In practise, “straight-through” does not mean every tick of your order is instantly passed through untouched. The broker still sets filters on which liquidity providers to use, how to size orders, when to reject fills and how to handle partial fills. Risk management rules may require certain pairs or client profiles to be hedged more conservatively or even to be internalised at times, especially if the firm runs a hybrid book.

The upside is that the broker has less reason to fight profitable clients. If your trades are passed on, the broker does not care if your strategy wins or loses over time, as long as your volume is steady enough to justify the relationship.

Practical issues traders notice with STP brokers

STP brokers still share some pain points with market makers. Spreads are variable because they depend on what the underlying providers stream. In fast markets, you can see spreads widen sharply and slippage on market orders. Stop orders may be filled worse than expected when liquidity thins around big news. None of that is “rigging”; it is how OTC markets behave when liquidity steps back.

On the plus side, you are more likely to see genuine positive slippage when the market moves through your level in your favour, since fills can be matched at better quotes from the aggregation. Many STP brokers publish some execution statistics or at least give more technical traders access to depth-of-market views on certain pairs.

STP models tend to appeal to swing traders, intraday traders who do not scalp the spread aggressively, and clients who want a bit more comfort that the broker’s profit does not depend directly on client losses. Account minimums are still manageable and platforms are familiar, often based on common retail front ends.

ECN (electronic communication network) forex brokers

ECN brokers are usually advertised as the “purest” type of forex broker. In an ECN model, your orders interact with a pool of quotes coming from banks, non-banks and sometimes other traders. The broker acts more like an access point to that pool than a principal taking the other side.

What “true ECN” really means

In a true ECN environment, the broker gives you access to an order book where participants can place bids and offers at different price levels. Spreads are not fixed; they reflect the best available bid and ask at that moment, often very tight during liquid sessions. The broker charges a separate commission per lot rather than widening the spread. You may also see volume-based pricing, where very active traders pay lower commissions.

Your orders can be matched against many different counterparties inside the network, not just one or two big banks. A limit order can even rest in the book and be hit by another participant, which feels closer to an exchange style market. That structure tends to favour traders who care a lot about raw pricing, depth and transparency.

What ECN trading feels like in practise

For a trader used to smooth, slightly artificial retail feeds, ECN trading can feel a bit more “wild”. Spreads can collapse to extremely tight levels at busy times, then suddenly widen when liquidity fades. During rollovers or around major events, you might see gaps, sharp spikes and lots of partial fills as the book reshuffles.

Because the broker earns from commissions, not spread markups, it has little motivation to skew pricing in its own favour. That said, you still rely on the broker’s technology, its choice of liquidity partners, and its risk controls. A weak ECN broker with fragile infrastructure can give you a worse experience than a solid market maker with strong systems.

ECN accounts often require higher minimum deposits and may impose higher minimum trade sizes than typical micro accounts. Platforms also tilt more to professional use: more focus on depth-of-market views, order book ladders and manual control of order types, less on fancy marketing widgets and “social” features.

For high-frequency trading, scalping around news, or strategies that depend on very tight spreads and fast fills, true ECN access can make a clear difference. For a casual trader opening a few swing trades a month, the benefits are less dramatic and the learning curve can even be annoying.

Hybrid forex brokers and A-book / B-book mixes

Many modern forex brokers do not sit neatly in just one bucket. They run hybrid models where some client flow is internalised and some is passed out to liquidity providers. This is where the A-book / B-book labels appear.

How hybrid books normally work

In a hybrid broker, client accounts can be profiled based on behaviour, size, strategy and even country. High-volume, profitable or institutional clients may be routed to the A-book and passed directly to external liquidity. Smaller accounts that trade in tiny size, use high leverage and churn often may be left on the B-book, meaning the broker takes the other side and hedges only at net level, if at all.

This profiling is not always evil. Hedging every micro-lot individually is expensive and sometimes impossible with institutional liquidity. Grouping and internalising small flow can keep costs down and spreads tight for retail clients. The problems start when the broker uses this flexibility to squeeze weak clients while giving nicer conditions to more informed ones, without clear disclosure.

What hybrid models mean for a retail trader

From outside, you often cannot tell whether you personally sit on the A-book or B-book at a hybrid broker. You can, however, pay attention to behaviour. Do you see fair positive and negative slippage. Are spreads in line with what you would expect from major interbank feeds. Does the broker share anything about how it manages risk and routing.

Many brokers that market themselves as “STP/ECN” are, in practise, hybrids. That by itself is not a red flag as long as the firm is honest about acting as principal at times and is backed by strong regulation, audited financials and reasonable risk controls. For most retail accounts, the experience will depend more on the firm’s integrity and technology than on whether your ticket is technically internalised or hedged a few milliseconds later.

Hybrid models are also common in regions where regulation forces certain handling of client funds but allows freedom on order routing. That lets brokers adapt to different liquidity conditions on different pairs and timezones, which can help spreads but complicates the marketing story.

Regulation, risk and account structure across broker types

Once you know the high-level types, the next question is simple: how does this broker model interact with regulation and account safety. The answer matters more as your deposit grows.

How regulation shapes broker behaviour

Forex brokers operate under different regulatory regimes: top-tier financial centres, mid-tier jurisdictions, and more permissive offshore locations. Each level sets rules on capital requirements, segregation of client funds, reporting and leverage caps.

Market makers in stricter jurisdictions may be required to hold client money in segregated accounts with recognised banks, maintain minimum capital buffers and join compensation schemes. That does not make losses impossible, but it reduces the odds that a single market event wipes out the firm along with client balances.

STP and ECN brokers under the same regulators face similar requirements, but they also rely heavily on the quality of their liquidity providers. A poorly chosen bank or prime-of-prime relationship can cause cascading problems if a partner cuts lines or withdraws in stress.

Offshore brokers often advertise very high leverage and few restrictions. They may be market makers, STP or hybrids, but with lighter supervision. For small accounts chasing aggressive trading that can feel attractive. The tradeoff is higher counterparty risk; if something goes wrong, your ability to recover funds is weaker.

Custody and account structure

Beyond regulation, look at who technically holds your money. At many retail brokers, especially market makers, your cash sits on the broker’s own balance sheet within a client pool account. At some ECN firms and professional setups, funds may be held in segregated trust structures or with clearing counterparties.

Different broker types also treat negative balances differently. Market makers in some regions must offer negative balance protection, meaning your account cannot go below zero in normal conditions. ECN or STP brokers that pass positions to liquidity providers may be exposed to gaps that create negative balances, which they may attempt to collect, unless they have explicit policies to forgive small deficits.

Swap and rollover handling is another area to watch. The broker sets or passes through swap rates on overnight positions. Market makers may adjust those more freely, while ECN brokers usually reflect what their liquidity providers charge, plus a margin. For carry trades, the details can add up over time.

No broker type gives a free pass on safety. A bad ECN broker can be more dangerous than a well-capitalised market maker with transparent policies. The key is to look at the full combination: type of broker, regulatory body, financial strength, and how they hold and report your balances.

Matching broker type to your trading style and capital

Once you know how market maker, STP, ECN and hybrid models behave, the practical question is “which type suits what I actually do in the market”.

Small account, occasional trading

If you trade a small account, open a few positions a week and mostly stick to major pairs, a well-regulated market maker or hybrid broker will often be enough. The ability to trade micro lots, low minimum deposits and simple account setups can matter more than shaving a fraction of a pip off spread.

What you want in that case is a clean trading environment: stable platform, honest communication about outages or issues, reasonable spreads in normal times and no wild widening in every minor news release. A clear negative balance policy is also helpful, since high leverage and small accounts can blow up fast.

Active intraday trader or scalper

If you scalp, trade during news, or run strategies that submit many orders per day, broker type matters more. Spreads, latency and the way the broker handles slippage can be the difference between a strategy that is viable and one that slowly bleeds.

Here, STP and ECN setups start to look more attractive. You want raw or near-raw pricing with a transparent commission model, access to a solid set of liquidity providers, and a platform or API that handles rapid order submission without freezing. Market makers can still work if they genuinely offer tight spreads and respect profitable clients, but many small dealing desks are not built for heavy scalping flow and may respond with higher spreads or trade restrictions.

Larger accounts and semi-professional traders

If you trade larger capital or treat trading as a serious secondary income, broker risk becomes business risk. At that point many traders start favouring better regulated STP or ECN firms, sometimes even splitting capital across two or three brokers with different models.

You may accept slightly higher explicit costs in exchange for stronger custody, more conservative risk controls and clearer legal recourse. Access to APIs, FIX connectivity, custom margin arrangements and deeper liquidity pools becomes more relevant than pretty mobile apps.

For some traders the final step is moving from pure retail forex brokers into multi-asset brokers, futures FCMs or even bank prime-of-prime relationships. At that stage, classification as “forex broker type” matters less than the quality and diversity of venues you can access.

This article was last updated on: February 17, 2026